The foundation of NUCFDC stems from recommendations of multiple Committees/ Working Groups on UCBs constituted by Reserve Bank of India (RBI), including those of Viswanathan Committee (2006), V S Das Committee (2009), Malegam Committee (2010) and R Gandhi Committee (2014).

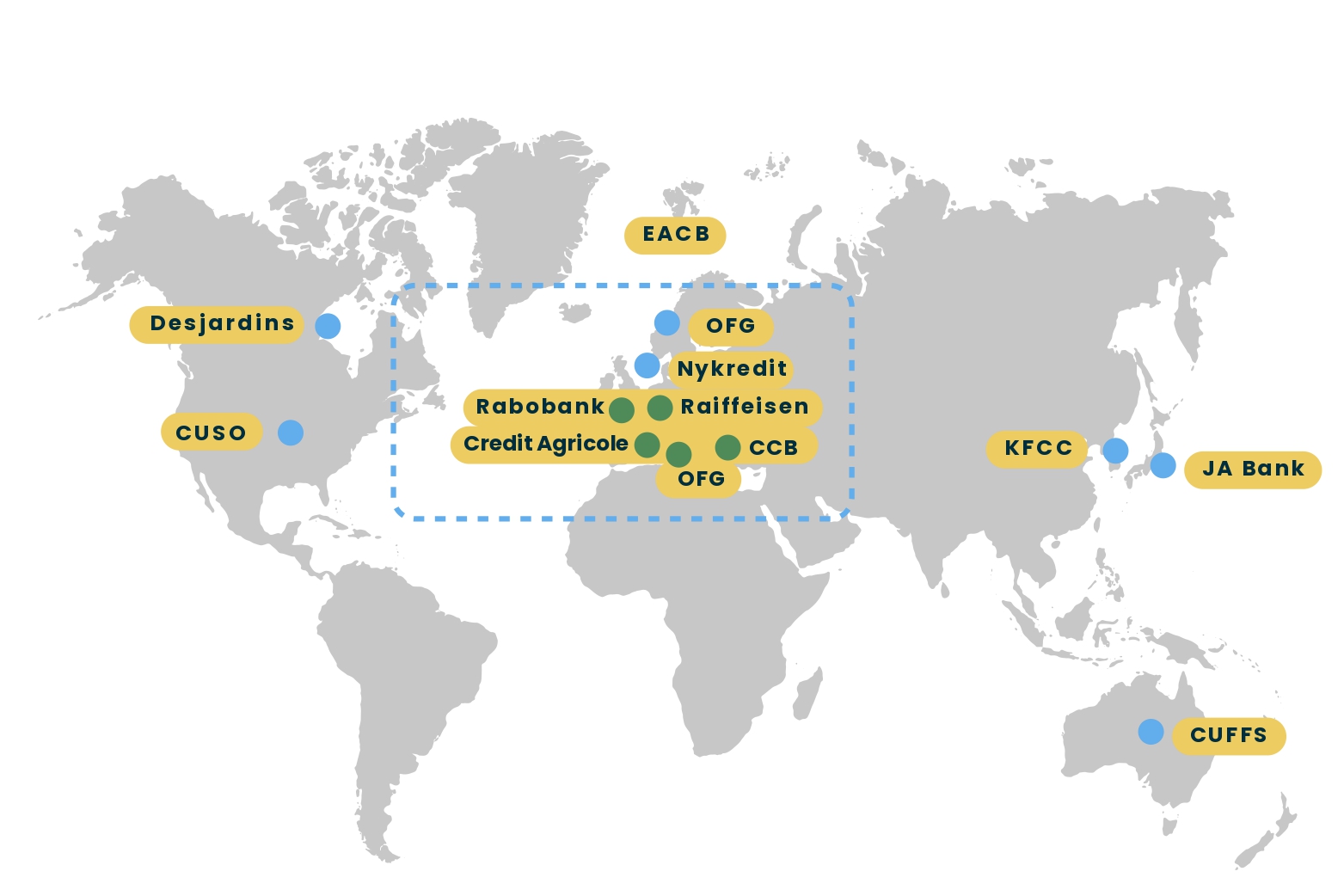

These Committees studied and took inspiration from successful global umbrella organizations like Rabobank (Netherlands), Credit Agricole (France), Raiffeisen Banking Group (Austria), Central Co-operative Bank (Bulgaria), Co-operative Financial Network (Germany), European Association of Co-operative Banks (European Union), Credit Union Service Organizations (USA), Desjardins (Canada), and JA Bank Group (Japan); and recommended a similar umbrella to address the infirmities in India's UCB sector comprising over 1700 UCBs of different sizes.

Emphasis on capacity building through fund-based and non-fund-based services.

Focus on implementing state-of-the-art IT platforms and plug-and-play services at affordable costs.

Proposal to connect India’s 1,470 UCBs and 11,000 branches to enhance synergy, economies of scale, and competitiveness.

Aimed at improving the stability of the sector and boosting public trust

Establishment of an SRO to provide necessary regulatory comfort.

We focus on advancing Digital Banking, Cybersecurity, Safety and Infrastructure, Capacity Building and Training, Enhanced Compliance and Government Position, Transparency and Cost Efficiency Benefits through Collective Negotiation, Procurement Optimization and Resource Sharing.

RBI approved the umbrella project in June 2019, with support from the Ministry of Cooperation, Government of India, and RBI.

Initial discussions and recommendations.

Key committee formed for further development.

Committee formed to address cooperative banking issues.

Continued efforts to improve the sector and address challenges.

Resolution by National Federation of Urban Cooperative Banks and Credit Societies.

Official approval from the Reserve Bank of India and capital raised for operations.

Official licensing and commencement of NUCFDC operations.

To strengthen India’s UCB sector through robust support, strong governance, and enhanced IT and digital capabilities, to face competition and contribute to the nation’s economic and social growth.

To build a strong foundation that drives the healthy growth of UCB sector, leveraging digital and emerging technologies to offer the full suite of banking related systems and services, thereby positioning UCBs in a competitive digital financial landscape.

NUCFDC plays a key role in India’s mission to strengthen cooperative banks, aligning with the government’s vision of financial inclusivity and “Sahakar Se Samriddhi.” Supported by government initiatives, we empower UCBs to reach new heights, contributing to economic growth and financial security.

Empowering UCB boards with enhanced decision-making capabilities.

Permitting UCBs to offer doorstep banking, fulfilling community needs.

Extended timelines for UCBs to meet PSL targets, reinforcing their social responsibility.

NUCFDC tailors its support to meet the evolving needs of Urban Cooperative Banks. Our services address liquidity, compliance, and modernization challenges, ensuring UCBs can operate confidently and effectively.

Immediate support for cash flow stability.

User-friendly tools and templates to simplify adherence to guidelines.

Modernizing operations to keep pace with the digital age.

Collaborative platforms for shared growth and innovation.

NUCFDC offers a comprehensive suite of specialized services tailored to the needs of UCBs

lorem ipsum

lorem ipsum

lorem ipsum

lorem ipsum

Chairman Emeritus, NAFCUB

Chairman, NUCFDC

MD, NCDC

Director, Saraswat Co-operative Bank Limited

Practicing Chartered Accountant

Ex-CMD of Punjab National Bank, Currently on board of Axis Bank & IFTAS

Former AGM, RBI, Chairman - Shalimar Paints Ltd. , Board Member of JIndal Stainless Ltd. & Aurionpro Solutions Ltd.

CIO and CISO of Gujarat State Coop Bank, Ex-Indian Army

Chief Executive Officer

Chief Technology Officer

Chief Relationship Officer

Chief Financial Officer

Company Secretary

Former Executive Director, RBI

Former Chief General Manager, RBI

Former Chief Executive Officer, NAFCUB